Case Studies: ACME Scientific

Industry: Medical, Biotech & AgTech

Company Stage: Startup

Services Provided: Part-time CFO

RM Partner:

Length of Engagement: ~2 years

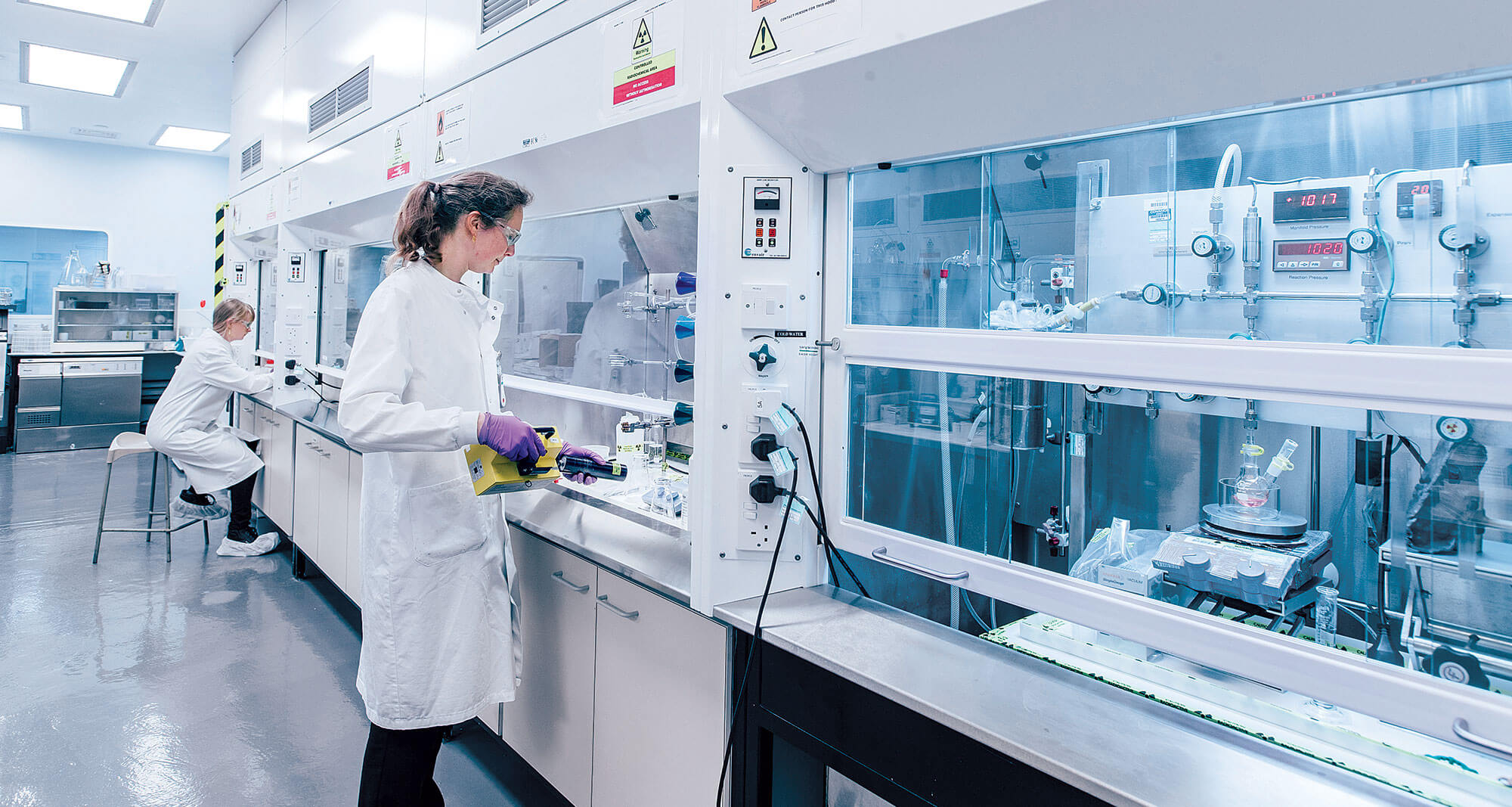

“ACME Scientific” uses novel epigenomic editing techniques to improve understanding of genome structure and function to identify potential new drug targets.

The Challenge

Creating something out of thin air typifies most scientific research companies, and it was certainly true for ACME Scientific. With technology licensed from Duke University and a convertible note funding startup operations, ACME Scientific needed expert support in creating a profitable business from the ground up.Audit Oversight

and Management

Talent Acquistion

via HR Support

Acquisition Guidance

and Due Diligence Support

The Solution

With headquarters in the Research Triangle, Rankin McKenzie partners knew exactly how to address ACME Scientific’s needs. Cash control and budget management are financial priorities for research labs with expensive equipment and top-shelf researchers and engineers, so Steve Weiner was swiftly identified as a compatible partner for the company. Upon meeting with the client team, Steve was tasked with building out the back office operation for the company nearly from scratch.The Partnership

During his tenure, Mr. Weiner worked in tandem with ACME Scientific’s CEO (an experienced fractional executive) to build out company operations so that the remaining business leaders could focus on further developing the firm’s licensed technology. Mr. Weiner worked with the existing bookkeeper to build out a financial reporting structure from the ground up and brought on a junior accountant as operations increased. Within six months the company grew to about 15 scientists, putting Mr. Weiner at the center of talent management, helping to recruit the right people at the right price.After little more than a year, operations kicked into fifth gear when a foreign-based multinational corporation made a purchase offer for ACME Scientific. Mr. Weiner then had four months to guide the company through a third-party financial audit while working with the CEO to respond to due diligence inquiries. Post-closing, Mr. Weiner supported the new leadership team with fully incorporating the books before ultimately concluded the engagement.